Tracking expenses is essential for managing your finances. Excel offers a simple, effective way to do this.

Are you struggling to keep track of your spending? Excel can be a powerful tool for organizing your finances. With its user-friendly interface, you can easily monitor where your money goes. This guide will help you learn how to track expenses on Excel step-by-step.

From setting up your spreadsheet to entering data, you’ll find it straightforward. Whether for personal budgeting or managing business costs, Excel has you covered. Ready to take control of your finances? Let’s dive into the world of expense tracking with Excel.

Table of Contents

ToggleIntroduction To Expense Tracking

Managing personal or business finances can be challenging. Tracking expenses is a crucial part of this process. By documenting every expenditure, you can gain a clear picture of your financial health. This practice helps in budgeting, saving, and making informed financial decisions.

Importance Of Tracking Expenses

Tracking expenses helps identify spending patterns. It can reveal where your money goes. This insight is essential for creating a realistic budget. It also aids in cutting unnecessary costs and saving more. Consistently tracking expenses can prevent overspending and debt.

Benefits Of Using Excel

Excel is a powerful tool for expense tracking. It offers flexibility and ease of use. You can customize spreadsheets to fit your needs. Excel allows for quick data entry and calculations. It also provides visual aids like charts to track spending over time. This makes it easier to understand your financial habits.

Setting Up Your Excel Sheet

Setting up an Excel sheet to track expenses can seem daunting. Yet, with a few simple steps, anyone can do it. This guide will walk you through creating a new workbook and choosing the right template for your needs. Let’s get started.

Creating A New Workbook

Open Excel on your computer. Click on “File” in the top menu. Select “New” from the drop-down menu. This will open a blank workbook. You can name your workbook by clicking on “File” again and choosing “Save As.” Type a name that reflects your goal, like “Expense Tracker.” Save it to a location you can easily find.

Choosing A Template

Excel offers many templates that make tracking expenses easier. Click on “File” and then “New.” In the search bar, type “expense tracker.” Browse through the options available. Choose a template that fits your needs. Click on it to open. This will save you time by providing a ready-made structure. You can customize it as you go.

Some templates may have categories like “Groceries,” “Rent,” and “Utilities.” You can add or remove these categories as needed. The template will also have columns for dates, amounts, and descriptions. This makes it easy to log each expense clearly. Now, you are ready to start tracking your expenses.

Organizing Your Data

Organizing your data is vital for effective expense tracking on Excel. This process helps you keep everything in order, making it easier to understand your spending. A clear structure can save time and reduce stress. Let’s dive into the steps you can take to organize your data.

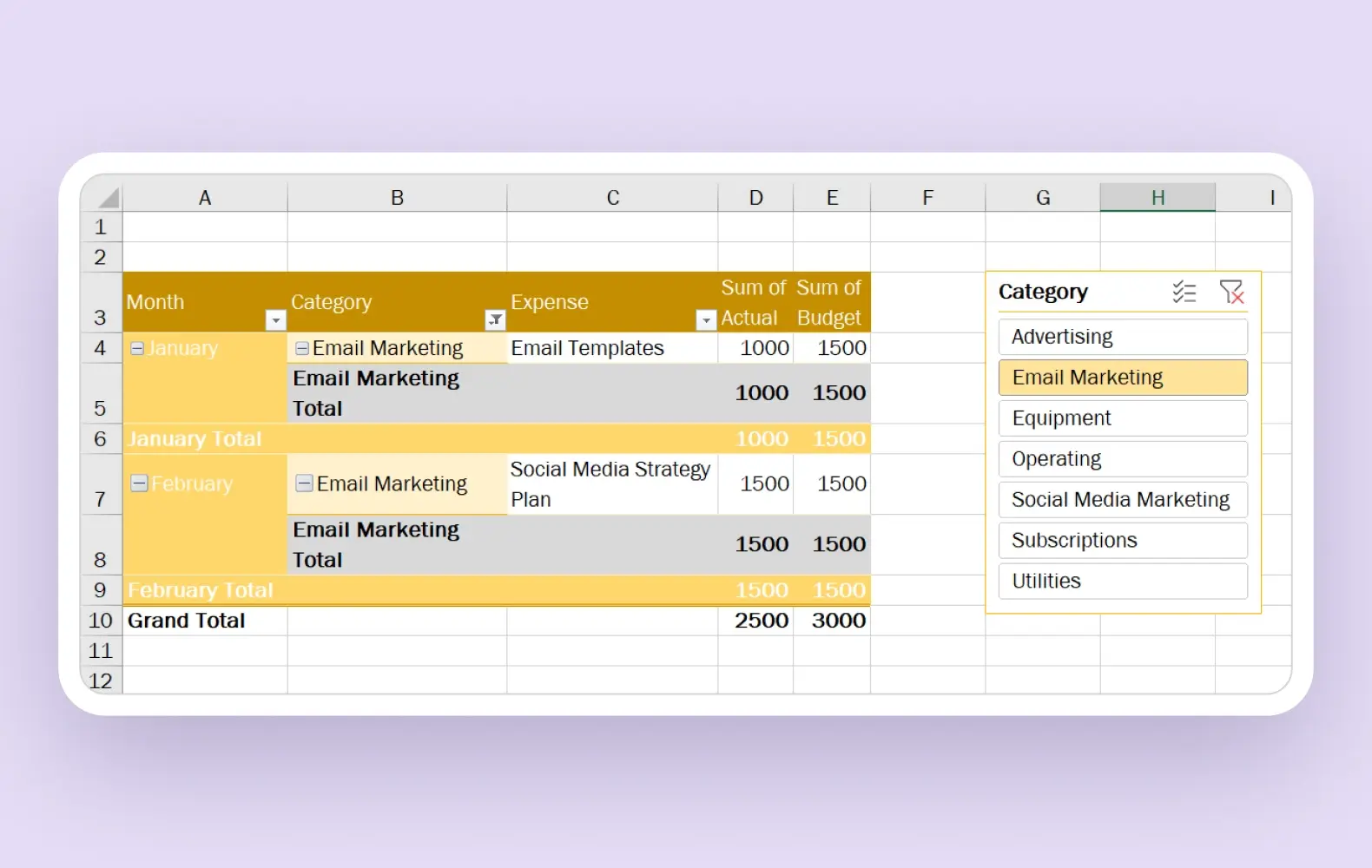

Categorizing Expenses

First, start by categorizing your expenses. This step ensures that each expense falls into a specific group. Common categories include rent, groceries, utilities, and entertainment. You can create custom categories based on your spending habits. Clear categories make it easy to see where your money goes.

To do this, list your categories in a separate column. Label it “Category.” As you record each expense, assign it to the correct category. Over time, you will see patterns and identify areas to cut back or adjust.

Setting Up Columns And Rows

Next, set up your columns and rows. Start with basic columns like Date, Description, Amount, and Category. You can add more columns as needed, such as Payment Method or Notes. Each row will represent a single expense entry.

Having a consistent format helps you maintain accuracy. It also simplifies the process of updating your spreadsheet. By setting up columns and rows, you create a clear and organized layout. This structure will help you track your expenses with ease.

Credit: create.microsoft.com

Entering Expense Data

Tracking expenses in Excel can help you manage your finances better. This section will guide you on how to enter your expense data efficiently. Accurate data entry is key to keeping your records organized.

Adding Daily Transactions

Start by opening your Excel spreadsheet. Create columns for the date, description, category, and amount. These columns will help you sort and filter your data easily. To enter a transaction, fill in each column with the relevant information. For example, if you bought groceries, enter the date, write “groceries” in the description, select the category “food,” and input the amount spent.

Make it a habit to add transactions daily. This practice ensures you don’t forget any expenses. Daily entries also make it easier to track your spending trends over time. You can review your expenses weekly or monthly to stay on top of your finances.

Using Date Formats

Excel offers various date formats to suit your needs. Using the correct date format helps keep your data consistent. To format the date, select the cell or column with dates. Right-click and choose “Format Cells.” A dialog box will appear with different date formats. Choose the one that fits your preference. For example, you can use “MM/DD/YYYY” or “DD/MM/YYYY.”

Consistent date formats make sorting and filtering your data simpler. It also helps avoid errors that could arise from mixed date formats. Properly formatted dates ensure your expense tracking remains accurate and reliable.

Using Formulas For Calculation

Using formulas for calculation in Excel can make tracking expenses much easier. Excel’s powerful functions help to automate and simplify your financial management. This way, you can focus on analyzing your spending habits.

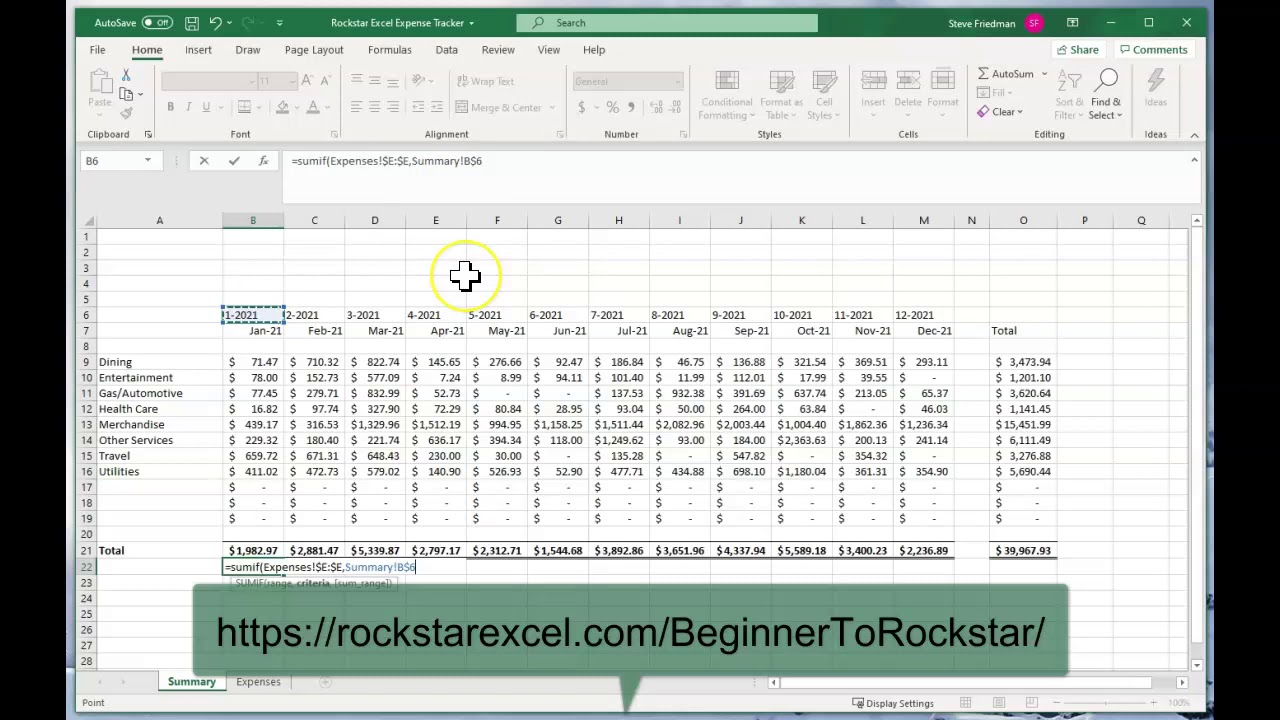

Summing Up Expenses

To sum up your expenses, use the SUM function. This formula adds up a range of cells. For instance, if your expenses are listed in cells B2 to B10, type =SUM(B2:B10). This will give you the total amount spent. It’s a straightforward way to see your overall expenses at a glance.

Calculating Monthly Totals

Calculating monthly totals is simple with Excel. Use the SUMIF function to add expenses by month. For example, if your dates are in column A and expenses in column B, type =SUMIF(A2:A31, "January", B2:B31). This will sum all expenses for January. Adjust the formula for other months by changing “January” to the desired month.

Using these formulas will help you keep track of your finances. It streamlines the process, making it easier to manage your expenses. Excel is a powerful tool for anyone looking to get a better handle on their spending.

Visualizing Your Data

Track expenses on Excel easily by creating organized spreadsheets. Input your income and costs, then use formulas to calculate totals. Keep your financial data clear and accessible.

Tracking expenses in Excel can be more than just numbers. By visualizing your data, you can understand your spending better. Excel offers powerful tools to make this easy and clear.Creating Charts And Graphs

Charts and graphs help you see patterns quickly. They turn your expense data into visual stories. To create a chart, select your data. Click on the “Insert” tab. Choose the type of chart you want. Bar charts, pie charts, and line graphs work well for expenses. Customize the chart to fit your needs. This way, you see where your money goes.Using Conditional Formatting

Conditional formatting highlights important data. It changes the cell color based on rules you set. To use it, select the cells you want. Click on “Home,” then “Conditional Formatting.” Choose a rule type. For example, you can highlight expenses over a certain amount. This makes it easy to spot high costs. Conditional formatting adds color to your data. It helps you see trends at a glance. “`Analyzing Spending Patterns

Analyzing your spending patterns is crucial for managing your finances effectively. By understanding where your money goes, you can make informed decisions about budgeting and saving. Excel is a powerful tool that helps you track and analyze these patterns with ease.

Identifying Trends

Identifying trends in your spending can reveal a lot about your financial habits. Use Excel to create charts and graphs that visually represent your expenses over time. This way, you can easily spot any spikes or dips in spending.

For example, you might notice that your grocery bills are higher during certain months. This could be due to holiday seasons or special occasions. Recognizing these trends allows you to plan better and allocate your budget more effectively.

Another way to identify trends is by categorizing your expenses. Group your spending into categories like groceries, entertainment, and utilities. Excel’s filtering features can help you see which category takes up most of your budget.

Comparing Monthly Expenses

Comparing your monthly expenses is an excellent way to keep your budget on track. Create a table in Excel that lists your monthly spending for each category. This allows you to compare one month to another easily.

For instance, if you spent $200 on dining out in January and $300 in February, you can ask yourself what changed. Did you dine out more often, or did you choose more expensive restaurants? Knowing this helps you adjust your habits accordingly.

Excel’s conditional formatting feature can also be handy. You can set it up to highlight any months where your spending exceeds a certain threshold. This visual cue can serve as a quick reminder to cut back.

Are there specific months where your expenses are consistently higher? Understanding why this happens can help you prepare in advance, ensuring you’re not caught off guard.

Credit: monday.com

Tips For Effective Expense Tracking

Easily track expenses on Excel by creating a simple spreadsheet. List categories, dates, and amounts. Regular updates help manage your budget effectively.

Tracking expenses in Excel can be a game-changer for managing your finances. It allows you to see where your money is going and make informed decisions. However, to make the most of it, you need some effective strategies. Here are some tips to ensure your expense tracking is accurate and useful.Regular Updates

Update your Excel sheet regularly. Make it a habit to log your expenses daily or weekly. This helps you avoid forgetting any transactions. Frequent updates also give you real-time insights into your spending habits. You can quickly spot if you’re overspending in any category and adjust accordingly. Set a reminder on your phone or calendar to update your Excel sheet. This small step can make a big difference in staying on top of your finances.Double-checking Entries

Always double-check your entries for accuracy. A small mistake can lead to incorrect data, which can affect your budgeting. Take a few minutes to review your recent entries. Ensure the amounts, dates, and categories are correct. It might seem tedious, but it saves time correcting errors later. Consider using Excel’s built-in formulas to cross-verify totals. This can help you identify any discrepancies quickly. By following these simple yet effective tips, you can make your expense tracking in Excel more accurate and beneficial. What strategies do you use to keep your finances in check? Share your thoughts!

Credit: m.youtube.com

Frequently Asked Questions

How Do I Track Expenses In Excel?

Open Excel and create columns for date, description, category, and amount. Enter your expenses in rows. Use formulas to sum totals.

How To Create An Expenses Spreadsheet In Excel?

Open Excel and create a new spreadsheet. Label columns as Date, Description, Category, Amount. Input your expenses. Use formulas for totals. Save the file.

How To Manage Personal Expenses In Excel?

To manage personal expenses in Excel, create a budget spreadsheet. List categories, input incomes, and record expenditures. Use formulas to track totals and balances. Regularly update and review the data to stay on budget.

Does Excel Have A Bookkeeping Template?

Yes, Excel offers various bookkeeping templates. You can find them under “Templates” in Excel or download from Microsoft Office’s website.

Conclusion

Tracking expenses on Excel is simple and effective. It helps you stay organized. You can monitor spending and savings easily. Regularly updating your sheet ensures accuracy. Use charts for clear visuals. Customize categories to suit your needs. Excel offers flexibility and control.

Start tracking today to manage your budget better. Follow these tips to keep finances in check. Consistent tracking leads to smarter financial decisions. Excel’s tools make expense management easy and efficient. Stay on top of your finances with Excel. Happy budgeting!