In today’s fast-paced business world, making sense of financial data is crucial. Financial Fusion, an AI-powered CFO tool, transforms complex financial data into clear, actionable items.

Financial Fusion is designed to simplify financial data management and enhance decision-making. This AI-powered tool provides intelligent insights, real-time updates, and customizable reporting. It seamlessly integrates with popular accounting tools like QuickBooks, Xero, and Shopify. By using Financial Fusion, C-suite executives, consultants, and small businesses can save time and make better decisions. The tool offers various pricing options, starting from a one-time purchase of $29. Financial Fusion also includes a 60-day money-back guarantee. Learn more about Financial Fusion here.

Table of Contents

ToggleIntroduction To Ai Cfo

In today’s rapidly evolving business world, managing finances effectively is crucial. The complexity of financial data can overwhelm even the most experienced professionals. Enter the AI CFO, a tool designed to transform this complexity into clear, actionable insights.

What Is Ai Cfo?

The AI CFO is an intelligent financial tool powered by advanced AI algorithms. It analyzes vast amounts of financial data to provide precise insights. One such tool is Financial Fusion.

Financial Fusion integrates seamlessly with popular accounting tools like QuickBooks, Xero, Zoho, Excel, Airtable, and Shopify. This makes financial data management simpler and more efficient.

Purpose And Importance Of Ai Cfo In Modern Business

The main purpose of an AI CFO is to enhance decision-making for businesses by simplifying financial data. Let’s look at the key reasons why AI CFOs are important:

- AI-Powered Insights: Analyzes financial data with precision-driven AI for deeper clarity.

- Real-Time Updates: Provides real-time insights, crucial for timely decision-making.

- Customizable Reporting: Generates tailored reports that highlight key metrics, supporting business goals.

- Seamless Integrations: Syncs with existing accounting systems, saving time and streamlining operations.

Financial Fusion, for instance, offers several benefits:

| Feature | Benefit |

|---|---|

| AI-Powered Insights | Provides deeper financial clarity |

| Real-Time Updates | Enhances decision-making |

| Customizable Reporting | Supports business goals |

| Seamless Integrations | Streamlines financial operations |

Financial Fusion offers different pricing tiers to suit various needs:

- License Tier 1: One-time purchase of $29. Includes lite month-end report and profit and loss for 1 company.

- License Tier 2: One-time purchase of $99. Includes detailed reports, balance sheet, and reviews for 1 company.

- License Tier 3: One-time purchase of $199. Includes detailed reports, balance sheet, and reviews for 5 companies.

With a 60-day money-back guarantee, Financial Fusion provides a risk-free way to enhance financial management. Activate your license within 60 days of purchase, and enjoy lifetime access to the platform with the ability to upgrade or downgrade between license tiers as needed.

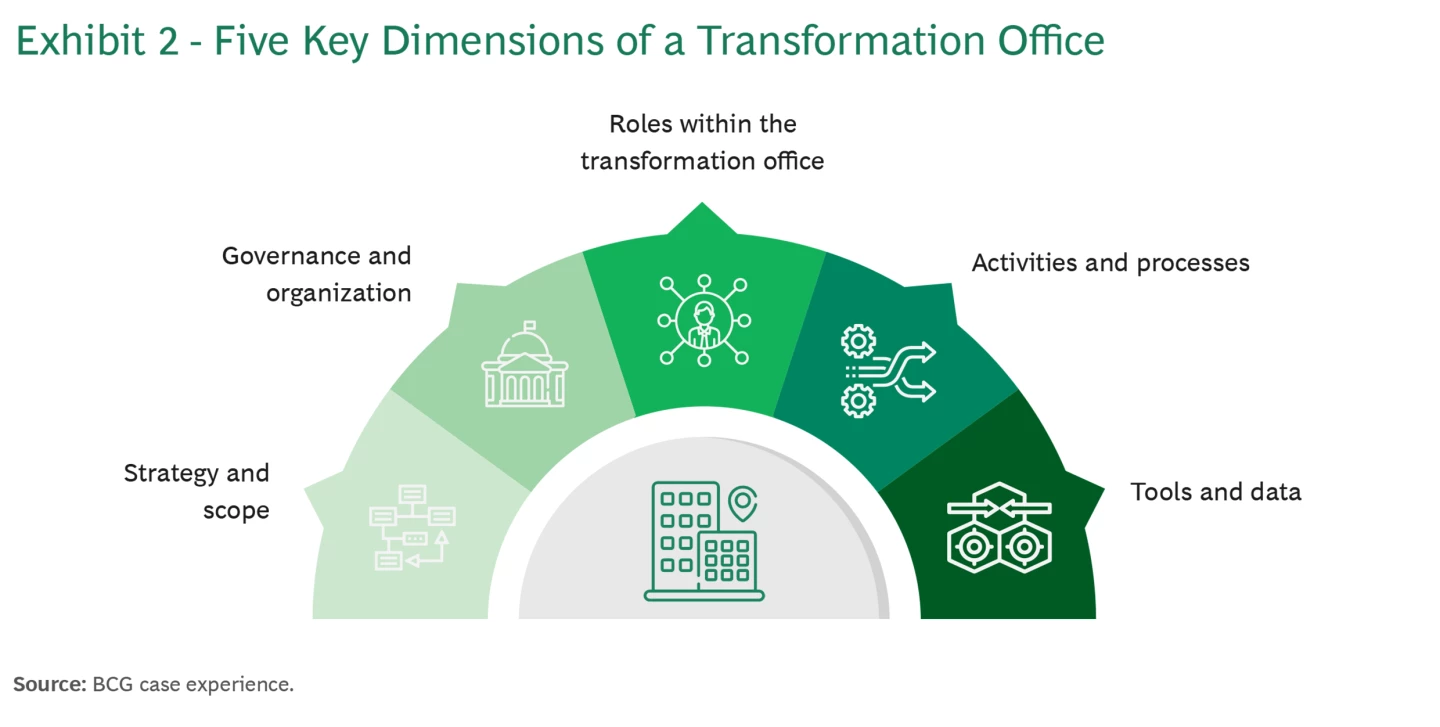

Credit: www.bcg.com

Key Features Of Ai Cfo

Discover how Financial Fusion, an AI-powered financial tool, transforms complex financial data into clear, actionable items. This section delves into the key features that make Financial Fusion an essential asset for C-suite executives, consultants, and small businesses.

With AI-Powered Insights, Financial Fusion analyzes financial data with precision. The AI engine dives deep into your data, providing deeper financial clarity. This feature helps businesses simplify financial data management, saving time and reducing errors.

Financial Fusion offers Real-Time Updates that enhance decision-making. Users gain instant insights into their financial status, which is crucial for timely and informed decisions. Real-time reporting ensures you are always up-to-date with your business finances.

Predictive analytics in Financial Fusion helps anticipate future financial trends. This feature uses historical data and AI algorithms to forecast financial outcomes. Businesses can then prepare for future challenges and opportunities with confidence.

Financial Fusion provides Customizable Reporting dashboards that highlight key metrics. Users can generate tailored reports to suit their specific needs. These dashboards present data clearly, supporting business goals and making complex data easy to understand.

Seamless integration with tools like QuickBooks, Xero, Zoho, Excel, Airtable, and Shopify ensures streamlined financial operations. This feature allows Financial Fusion to sync with your existing accounting systems, making it easy to manage multiple data sources in one place.

| License Tier | Pricing | Features |

|---|---|---|

| License Tier 1 | $29 (originally $490) | Lite month-end report, Lite profit and loss for 1 company |

| License Tier 2 | $99 (originally $980) | Detailed month-end report, Detailed profit and loss, Balance sheet, Quarterly reviews, Yearly reviews for 1 company |

| License Tier 3 | $199 (originally $1,470) | Detailed month-end report, Detailed profit and loss, Balance sheet, Quarterly reviews, Yearly reviews for 5 companies |

With Financial Fusion, simplify your financial data management and make better decisions with real-time insights. Explore the full potential of AI CFO and transform your financial operations today.

Automated Data Analysis

In today’s fast-paced financial landscape, Automated Data Analysis is a crucial component for effective financial management. Financial Fusion leverages AI to transform complex financial data into clear, actionable insights. This automation empowers financial teams to make informed decisions quickly and efficiently.

How It Simplifies Complex Data

Financial Fusion uses AI-powered insights to analyze extensive financial data. The tool simplifies complex data through:

- Real-Time Updates: It offers real-time insights, ensuring up-to-date financial information.

- Customizable Reporting: Generate tailored reports that highlight essential metrics, making the data more understandable.

- Seamless Integrations: Sync with tools like QuickBooks, Xero, Zoho, Excel, Airtable, and Shopify to streamline financial operations.

Benefits For Financial Teams

Financial Fusion offers multiple benefits for financial teams, including:

- Enhanced Decision-Making: Real-time insights help teams make better decisions faster.

- Time Savings: Automating data analysis saves significant time by connecting multiple data sources.

- Improved Data Management: The tool simplifies financial data management, reducing errors and improving accuracy.

Accuracy And Speed Improvements

Accuracy and speed are critical in financial management. Financial Fusion enhances both by:

- Precision-Driven AI: The AI analyzes data with high precision, ensuring accurate financial insights.

- Real-Time Processing: Real-time updates provide immediate insights, accelerating the decision-making process.

| License Tier | Price | Features |

|---|---|---|

| License Tier 1 | $29 (originally $490) | Lite month-end report, Lite profit and loss for 1 company |

| License Tier 2 | $99 (originally $980) | Detailed month-end report, Detailed profit and loss, Balance sheet, Quarterly reviews, Yearly reviews for 1 company |

| License Tier 3 | $199 (originally $1,470) | Detailed month-end report, Detailed profit and loss, Balance sheet, Quarterly reviews, Yearly reviews for 5 companies |

With these features and benefits, Financial Fusion stands out as a powerful tool for automating and simplifying financial data analysis.

Credit: www.unit4.com

Real-time Financial Reporting

Financial Fusion transforms complex financial data into clear, actionable items. One of its standout features is real-time financial reporting. This allows businesses to stay ahead with instant insights into their financial health.

Instant Access To Financial Health

With real-time updates, Financial Fusion provides instant access to your company’s financial health. This means you can monitor key metrics as they change. No more waiting for end-of-month reports.

Real-time insights help in identifying potential issues early. This allows for quick corrective action. It also ensures that you have the most current data at your fingertips.

Enhanced Decision-making Processes

AI-powered insights from Financial Fusion enhance decision-making. The tool analyzes data with precision, offering deeper financial clarity. It takes the guesswork out of interpreting complex data.

With customizable reporting, you can generate reports that highlight key metrics relevant to your business goals. This makes it easier to make informed decisions that drive your business forward.

Reducing Reporting Delays

Financial Fusion integrates seamlessly with popular accounting tools like QuickBooks, Xero, and Zoho. This reduces reporting delays significantly. Synchronizing with these tools streamlines your financial operations.

By connecting multiple data sources, Financial Fusion saves time. It ensures that all your financial data is centralized and up-to-date. This minimizes the lag between data collection and reporting.

Predictive Analytics

Financial Fusion leverages predictive analytics to transform complex financial data into actionable insights. This powerful AI tool helps businesses make informed decisions by forecasting financial trends, identifying potential risks, and aiding in strategic planning and budgeting.

Forecasting Financial Trends

Financial Fusion uses AI-powered insights to analyze historical data and predict future financial trends. This enables businesses to anticipate market changes and adjust strategies accordingly. The real-time updates feature ensures that the forecasts are always current, providing a reliable basis for decision-making.

- Analyze past financial data

- Predict future trends

- Adjust strategies based on forecasts

Identifying Potential Risks

One of the key advantages of Financial Fusion is its ability to identify potential risks. The AI technology scrutinizes financial data to detect anomalies and patterns that may indicate risks. This early warning system helps businesses mitigate risks before they escalate.

| Feature | Benefit |

|---|---|

| Risk Detection | Identify financial anomalies |

| Pattern Recognition | Spot risk indicators |

| Early Warning | Mitigate risks early |

Strategic Planning And Budgeting

Financial Fusion aids in strategic planning and budgeting by providing customizable reports that highlight key metrics. These reports are tailored to support business goals and integrate seamlessly with existing accounting systems like QuickBooks and Xero. This ensures that businesses can plan and budget effectively, based on accurate and up-to-date financial data.

- Generate tailored reports

- Highlight key financial metrics

- Support business goals with accurate data

With Financial Fusion, businesses have a powerful tool to navigate the complexities of financial data. The combination of predictive analytics, risk identification, and strategic planning capabilities ensures that businesses are well-equipped to make informed decisions.

Customizable Dashboards

Financial Fusion’s customizable dashboards provide a personalized and streamlined view of your financial data. These dashboards are designed to simplify complex information, making it easier for users to make informed decisions.

Personalized Financial Insights

The dashboards offer personalized financial insights tailored to your specific business needs. You can view key metrics and data points that are most relevant to your operations. This customization ensures that you see what matters most, helping you focus on critical financial aspects.

- Real-time updates

- Customizable reporting

- Precision-driven AI analysis

User-friendly Interface

Financial Fusion boasts a user-friendly interface that simplifies navigation and data interpretation. The interface is designed to be intuitive, allowing users to effortlessly access and understand their financial data. This ease of use ensures that even users with limited financial expertise can efficiently manage their finances.

| Feature | Benefit |

|---|---|

| Seamless Integrations | Connect with QuickBooks, Xero, Zoho, and more |

| Real-Time Updates | Enhance decision-making with up-to-date data |

Tailoring To Specific Business Needs

Financial Fusion allows for tailoring to specific business needs. You can customize your dashboards to reflect the unique requirements of your business. Whether you need detailed profit and loss reports or balance sheets, the platform can generate reports that align with your business goals.

- Lite month-end report for basic needs

- Detailed profit and loss for comprehensive analysis

- Quarterly and yearly reviews for long-term planning

Integration With Existing Financial Systems

Integrating Financial Fusion with your existing financial systems is simple and efficient. This AI-powered tool ensures that your financial data management becomes seamless, enhancing your decision-making process. Let’s explore how Financial Fusion integrates smoothly with your current financial systems.

Seamless Data Integration

Financial Fusion excels in seamless data integration, making it easy to sync with your current financial tools. Whether you use QuickBooks, Xero, Zoho, Excel, Airtable, or Shopify, this AI CFO ensures all your financial data is consolidated in one place.

- QuickBooks

- Xero

- Zoho

- Excel

- Airtable

- Shopify

This feature saves you time and reduces the hassle of managing multiple data sources.

Compatibility With Popular Software

Financial Fusion offers compatibility with popular accounting software. This ensures that you don’t need to switch platforms or change your current financial systems. The tool integrates effortlessly, allowing you to continue using your preferred software while benefiting from advanced AI insights.

| Software | Compatibility |

|---|---|

| QuickBooks | Yes |

| Xero | Yes |

| Zoho | Yes |

| Excel | Yes |

| Airtable | Yes |

| Shopify | Yes |

Improving Data Consistency And Reliability

By integrating Financial Fusion with your existing systems, you enhance data consistency and reliability. This AI tool ensures that all your financial data is accurate and up-to-date. Real-time updates and customizable reporting features provide you with precise financial insights.

- Real-time updates ensure data accuracy.

- Customizable reports highlight key metrics.

- Consolidated data enhances decision-making.

These features help you maintain consistent and reliable financial data, crucial for making informed business decisions.

Pricing And Affordability Of Ai Cfo

Financial Fusion is an AI-powered financial tool that transforms complex financial data into clear, actionable insights. Understanding its pricing and affordability is crucial for businesses considering this solution.

Cost Breakdown

| License Tier | One-Time Purchase Price | Original Price | Included Features |

|---|---|---|---|

| License Tier 1 | $29 | $490 |

|

| License Tier 2 | $99 | $980 |

|

| License Tier 3 | $199 | $1,470 |

|

Value For Money

Financial Fusion offers great value for money. The one-time purchase pricing model ensures no recurring costs. With License Tier 1 at just $29, users get basic features that originally cost $490. License Tier 2, priced at $99, includes comprehensive reporting tools valued at $980. License Tier 3 offers extensive features for $199, compared to its original price of $1,470. Each tier provides a significant discount, making Financial Fusion an affordable choice for businesses.

Comparing With Traditional Financial Tools

Traditional financial tools often come with recurring subscription fees. These tools can cost hundreds of dollars per month. Financial Fusion, on the other hand, requires a one-time payment. This makes it a cost-effective alternative. Traditional tools may also lack seamless integrations. Financial Fusion integrates smoothly with QuickBooks, Xero, Zoho, Excel, Airtable, and Shopify. This integration simplifies financial management.

In summary, Financial Fusion’s pricing and affordability make it a viable option for businesses. Its one-time purchase model offers substantial savings. The tool provides comprehensive financial insights and seamless integrations, setting it apart from traditional financial tools.

Pros And Cons Of Ai Cfo

Considering the role of an AI CFO in transforming complex financial data into clear action items can be crucial. Let’s explore the advantages and potential drawbacks of using AI CFOs like Financial Fusion.

Advantages Of Using Ai Cfo

Using an AI CFO such as Financial Fusion comes with several advantages:

- AI-Powered Insights: The AI analyzes financial data with precision, providing deeper financial clarity.

- Real-Time Updates: Users receive real-time insights, which enhance decision-making processes.

- Customizable Reporting: It generates tailored reports that highlight key metrics and present data clearly.

- Seamless Integrations: The tool syncs with popular accounting tools like QuickBooks, Xero, and Zoho, streamlining financial operations.

- Time-Saving: By connecting multiple data sources, it saves time for users, allowing them to focus on strategic tasks.

Potential Drawbacks And Considerations

There are some potential drawbacks and considerations to keep in mind:

- Initial Setup: Integrating AI CFOs into existing systems may require initial setup time and effort.

- Cost: Although it simplifies financial data management, the cost may be a concern for some businesses, despite the one-time purchase model.

- Learning Curve: Users may need time to get accustomed to the new technology and its features.

Real-world Usage Feedback

Feedback from users of Financial Fusion highlights its practical benefits:

- Simplified Financial Management: Users appreciate how it simplifies financial data management.

- Enhanced Decision-Making: Real-time insights have been noted to significantly enhance decision-making capabilities.

- Time Efficiency: Many users find that the tool saves them time by connecting multiple data sources seamlessly.

- Custom Reports: Customizable reports help users align financial data with their business goals.

In summary, Financial Fusion as an AI CFO brings several benefits, though users should consider the initial setup and learning curve.

Recommendations For Ideal Users

Financial Fusion is a versatile AI-powered financial tool designed to assist various business types. Its ability to transform complex financial data into clear, actionable items makes it invaluable for a wide range of users. Here’s a closer look at who can benefit the most from Financial Fusion:

Small To Medium Enterprises

Small to medium enterprises (SMEs) often struggle with financial data management due to limited resources. Financial Fusion simplifies this process by offering:

- AI-powered insights for precise financial analysis.

- Customizable reporting to highlight key metrics.

- Seamless integration with popular accounting tools like QuickBooks and Xero.

These features help SMEs streamline their financial operations and make informed decisions, enhancing overall efficiency.

Large Corporations

Large corporations deal with massive amounts of financial data. Financial Fusion helps them by providing:

- Real-time updates for timely decision-making.

- Detailed month-end reports and balance sheets.

- Integration with multiple data sources like Zoho, Excel, and Shopify.

These capabilities ensure that large corporations maintain a clear view of their financial health, supporting strategic planning and execution.

Startups And Growth Companies

Startups and growth companies need to be agile and data-driven. Financial Fusion offers:

- Customizable reports to support business goals.

- Quarterly and yearly reviews for tracking progress.

- Seamless syncing with existing accounting systems.

These features enable startups to focus on growth by providing them with the financial clarity needed to scale effectively.

Industries That Benefit The Most

Financial Fusion is beneficial across various industries. Some of the key sectors include:

| Industry | Benefits |

|---|---|

| Retail | Streamlined financial operations, real-time sales insights. |

| Healthcare | Efficient financial management, customized reporting. |

| Technology | Seamless integration, AI-driven financial insights. |

| Consulting | Detailed reports, enhanced decision-making. |

These industries can leverage Financial Fusion to improve their financial processes and make data-driven decisions.

.png?width=638&height=359&name=1480x832%20(4).png)

Credit: blog.embarkwithus.com

Frequently Asked Questions

How Does An Ai Cfo Work?

An AI CFO uses advanced algorithms to analyze financial data. It identifies patterns and trends, transforming complex data into actionable insights. This helps businesses make informed decisions efficiently.

What Benefits Does An Ai Cfo Offer?

An AI CFO offers several benefits. It enhances data accuracy, reduces human error, and provides real-time insights. This leads to better financial decisions and improved business performance.

Can Ai Cfos Handle Large Datasets?

Yes, AI CFOs are designed to handle large datasets. They process vast amounts of financial data quickly and accurately. This ensures comprehensive analysis and actionable recommendations.

Is An Ai Cfo Cost-effective?

Yes, an AI CFO is cost-effective. It reduces the need for extensive human resources. This leads to significant savings in operational costs while maintaining high accuracy and efficiency.

Conclusion

Financial Fusion simplifies complex financial data into clear, actionable insights. It helps businesses make better decisions with real-time updates and customizable reports. Seamless integration with popular tools ensures smooth financial operations. Improve your financial management with Financial Fusion. Try it risk-free today with a 60-day money-back guarantee. Ready to transform your financial data? Visit Financial Fusion now.