Making 1 million dollars in the stock market is possible with smart strategies. Careful planning and informed decisions are essential for success.

Investing in the stock market can be a powerful way to grow your wealth. With the right approach, turning your investments into substantial returns is achievable. Many people dream of reaching the million-dollar mark, but it requires understanding market dynamics and making strategic moves.

In this blog post, we’ll explore key steps and tips to help you navigate the stock market effectively. Whether you’re a beginner or have some experience, this guide will provide valuable insights to help you aim for that significant financial milestone. Get ready to learn how to make informed investment choices and build a prosperous future.

Table of Contents

ToggleSetting Financial Goals

To make 1 million dollars investing in the stock market, start by setting clear financial goals. Consistently invest in diverse stocks and monitor your portfolio. Patience and regular contributions are key.

Setting financial goals is crucial to making 1 million dollars in the stock market. Without clear objectives, your investing journey might lack direction. By defining your target amount and establishing a timeline, you can stay focused and motivated.

Define Target Amount

First, decide how much you want to earn. Setting a clear target amount helps you measure your progress. For instance, you might aim for 1 million dollars. This specific target can drive your investment strategies and decisions. Consider your current financial situation and risk tolerance. If you’re just starting, smaller milestones can also be motivating. Think about how much you can reasonably invest each month to reach your goal.

Establish a Timeline

Determine a realistic timeline to achieve your financial goal. How long will it take to make 1 million dollars? Break down this timeline into smaller, manageable periods. For example, you could set quarterly or yearly goals. These checkpoints can help you adjust your strategy as needed. Don’t forget to factor in market fluctuations. Stock prices can be unpredictable. Setting a flexible timeline allows room for adjustments and keeps you on track. Achieving 1 million dollars in the stock market requires patience and persistence. How long are you willing to wait for your investments to grow?

Building a Solid Foundation

Building a solid foundation involves researching market trends and diversifying your portfolio. Consistent investment and patience are key to reaching the goal of one million dollars. Keep emotions in check and follow a disciplined strategy for long-term success.

Investing in the stock market can seem like a daunting task, especially if your goal is to make 1 million dollars. However, the journey begins with building a solid foundation. This foundation is crucial for your success, providing the knowledge and structure you need to make informed decisions and stay on track. Let’s dive into the essentials of creating a strong base for your investment journey.

Understand Basic Concepts

Before investing, it’s essential to grasp the basic concepts of the stock market. You should know what stocks are, how they work, and why their prices fluctuate. Take time to learn about terms like dividends, market capitalization, and price-to-earnings (P/E) ratio. This knowledge will help you make informed decisions and avoid costly mistakes. Are you familiar with the risks involved? Understanding the risk-reward ratio can help you determine how much you’re willing to invest and potentially lose. Remember, knowledge is power.

Create a Budget

Creating a budget is your next step. Determine how much money you can realistically invest without affecting your daily life. List your income and expenses to see how much you can set aside each month. Make sure your budget is flexible enough to handle unexpected expenses. Set financial goals. Do you want to save for retirement, buy a house, or pay for your child’s education? Having clear goals will keep you motivated and focused on your investment strategy. By understanding basic concepts and creating a budget, you’re laying the groundwork for a successful investment journey. What steps will you take today to build your foundation?

Choosing the Right Brokerage

Choosing the right brokerage can be the key to making your first million in the stock market. Not all brokerages are created equal. Each platform offers unique features, fees, and tools. To find the best fit, you need to compare platforms and evaluate fees and commissions. Let’s dive in.

Compare Platforms

First, explore different brokerage platforms. Research their reputation and user reviews. Look for platforms that offer the tools you need. These might include research reports, stock screeners, and educational resources. Ease of use is another important factor. The platform should be intuitive and user-friendly. A good mobile app can also enhance your trading experience. Security is paramount. Ensure the platform uses strong encryption and has a solid security record.

Evaluate Fees and Commissions

Fees and commissions can eat into your profits. Compare the costs across different brokerages. Look at trading commissions, account maintenance fees, and withdrawal fees. Some platforms offer zero-commission trades. But they might charge higher fees elsewhere. Be aware of hidden costs. These can include inactivity fees or fees for advanced tools. Lower fees mean more money stays in your pocket.

Remember, the cheapest option isn’t always the best. Balance cost with the value of services provided. A slightly higher fee might be worth it for better tools and support. Making an informed choice can set you on the path to growing your investment. Choose wisely and watch your money grow.

Credit: www.timothysykes.com

Diversifying Your Portfolio

Building wealth through the stock market requires a smart strategy. One key strategy is diversifying your portfolio. Diversification means spreading your investments across different assets. This helps reduce risk. If one investment loses value, others may gain. Here’s how to diversify your portfolio effectively.

Mix of Asset Classes

Include a mix of asset classes. Stocks, bonds, and real estate are examples. Stocks can offer high returns. Bonds provide stability. Real estate can provide steady income. Balancing these can protect your investments. Don’t put all your money in one type of asset.

Sector Allocation

Invest across different sectors. Technology, healthcare, and finance are major sectors. Each sector performs differently. If technology stocks drop, healthcare might rise. This balance reduces risk. Spread your investments across at least five sectors.

Research and Analysis

To make 1 million dollars investing in the stock market, research and analysis are essential. Identify strong companies, understand market trends, and diversify investments wisely.

Investing in the stock market can be a thrilling journey, but making a million dollars isn’t just about luck. It requires diligent research and analysis. Understanding the different methods of evaluating stocks is crucial. This helps you make informed decisions. Two of the most critical approaches are fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis involves examining a company’s financial health. This means looking at its revenue, earnings, future growth, return on equity, profit margins, and other data to determine if the stock is undervalued or overvalued. You need to dive into financial statements. This includes the income statement, balance sheet, and cash flow statement. Don’t let these terms intimidate you. Think of it like checking the health of a business. Are they making money? Are they in debt? Is their profit growing? Another key point is understanding the industry trends. For instance, if you’re looking at tech stocks, know what’s happening in the tech world. Are there new regulations? Is there a shift in consumer behavior? Remember to compare the company with its competitors. This gives you a relative perspective. Are they performing better or worse than others in the same industry?

Technical Analysis

Technical analysis is a different beast. It involves looking at the price movement and trading volume of stocks. You’re not interested in the company’s financial health. Instead, you focus on patterns and trends in stock prices. Use charts to analyze stock performance. Look for trends such as upward or downward movements. This helps you predict future price movements. Pay attention to indicators like moving averages, relative strength index (RSI), and Bollinger Bands. These tools help you identify potential buy or sell signals. For example, a moving average can show you the average price of a stock over a specific period. If the stock price crosses above its moving average, it might be a good time to buy. Technical analysis can be very subjective. What works for one person might not work for another. So, find your style and stick to it. By combining both fundamental and technical analysis, you can make more informed decisions. This approach helps you understand both the intrinsic value of a stock and its market behavior. Do you favor one method over the other? Or, do you find a blend of both gives you the best results?

Risk Management Strategies

Investing in the stock market can be rewarding, but it comes with risks. Managing these risks is crucial for achieving your financial goals. Here are some effective risk management strategies to help you navigate the market.

Set Stop-loss Orders

A stop-loss order is a tool to limit potential losses. It automatically sells a stock when it reaches a specific price. This prevents further loss if the stock price falls. Setting stop-loss orders helps protect your investment. It ensures you don’t lose more than you can afford.

To set a stop-loss order, decide the maximum loss you are willing to take. For example, if you buy a stock at $100, you might set a stop-loss at $90. If the stock drops to $90, the order executes, selling the stock. This strategy limits your loss to $10 per share.

Use Limit Orders

Limit orders allow you to buy or sell a stock at a specific price or better. This ensures you get the price you want or a better one. It helps you avoid overpaying for a stock or selling it too cheaply.

For example, if you want to buy a stock at $50, set a limit order at that price. The order will execute only if the stock price reaches $50 or lower. Similarly, if you want to sell a stock at $60, set a limit order at that price. The sale will happen only if the stock price reaches $60 or higher.

Using limit orders helps you control your investment decisions. It ensures you buy and sell at prices you are comfortable with.

Long-term Investment Strategies

Investing in the stock market can be a great way to grow your wealth. Long-term investment strategies are essential for making substantial gains over time. These strategies focus on patience and consistency. They help you avoid the pitfalls of short-term market fluctuations. Let’s explore two key strategies: Buy and Hold, and Dividend Reinvestment.

Buy and Hold

The Buy and Hold strategy involves purchasing stocks and holding them long-term. This method requires patience. You invest in solid companies with good potential. Over time, the value of these stocks increases. Historical data shows that the market grows over the long term. Holding stocks through ups and downs can yield significant returns. The key is to stay invested. Do not sell in panic during market drops. Trust in the growth potential of your chosen stocks.

Dividend Reinvestment

Dividend Reinvestment involves using dividends to buy more shares. Many companies pay dividends to their shareholders. These payments can be reinvested to purchase additional shares. This strategy compounds your returns. Over time, your number of shares grows. More shares mean higher dividends in the future. It creates a cycle of growth. Many brokerage firms offer Dividend Reinvestment Plans (DRIPs). These plans make reinvesting easy and automatic. Consistently reinvesting dividends can significantly increase your investment’s value over time.

Monitoring and Adjusting

Monitoring and adjusting your stock market investments is crucial for achieving your goal of making 1 million dollars. It’s not enough to buy stocks and forget about them. You need to keep an eye on your portfolio and make adjustments as necessary. This ensures that your investments stay aligned with your financial goals and risk tolerance.

Regular Portfolio Review

Regular portfolio reviews are essential. They help you understand how your investments are performing. You can identify which stocks are doing well and which aren’t.

I once noticed a tech stock in my portfolio that had consistently underperformed. After reviewing my portfolio, I decided to sell it and invest in a different sector. This decision helped improve my overall returns.

Set a schedule for these reviews. Quarterly reviews are a good starting point. This frequency allows you to make timely decisions without getting overwhelmed.

Ask yourself: Are your stocks meeting your expectations? If not, it might be time to make some changes. Regular reviews can help you catch issues early and take corrective actions.

Rebalancing Techniques

Rebalancing is adjusting the weight of the assets in your portfolio. If one stock has grown too much, it might be time to sell some of it. This helps maintain your desired level of risk.

Imagine you started with a 60% stock and 40% bond portfolio. If the stock market does well, your portfolio might shift to 70% stocks and 30% bonds. Rebalancing would involve selling some stocks and buying bonds to get back to your original allocation.

There are different rebalancing techniques. Some people rebalance based on time, like every quarter or year. Others rebalance based on thresholds, like if an asset class moves by a certain percentage.

Consider which technique fits your style. Regular time-based rebalancing might be easier to manage. Threshold-based rebalancing can be more responsive to market changes.

Remember, the goal is to keep your investments aligned with your risk tolerance and financial goals. So, find a method that works for you and stick with it.

Are you ready to make those necessary adjustments and watch your investments grow?

Staying Informed

Stay informed by researching stock market trends and news daily. Diversify your investments to manage risks effectively. Aim for long-term growth through consistent monitoring and analysis.

Staying informed is crucial if you aim to make 1 million dollars investing in the stock market. Markets are dynamic, and information can change rapidly. Being aware of the latest developments keeps you ahead of the curve.

Follow Market News

Consistently reading market news is a must. Subscribe to financial news sites like Bloomberg, Reuters, or CNBC. These platforms offer real-time updates on market trends, economic indicators, and major financial events. Podcasts can also be a great way to stay updated. Shows like “The Daily” and “Planet Money” provide insightful financial news and analysis. It’s easy to listen to them during your daily commute. Social media platforms can be valuable too. Follow market analysts and financial experts on Twitter or LinkedIn. Their insights can offer you a new perspective on market movements.

Use Financial Tools

Leverage financial tools to get detailed analysis. Tools like Yahoo Finance and Google Finance offer comprehensive data on stock performance. They help you track stock prices, market indices, and news related to your investments. Stock screeners are another useful resource. Websites like Finviz allow you to filter stocks based on specific criteria like market cap, sector, or dividend yield. This helps you identify potential investment opportunities quickly. Don’t underestimate the power of financial apps. Apps like Robinhood and ETRADE offer easy access to your portfolio and market news. They also provide instant notifications about significant changes in your investments. Staying informed can make a world of difference. How do you plan to stay ahead in the stock market game? Investing in your knowledge is just as important as investing in stocks.

Credit: www.barbabos.ubuy.com

Emotional Discipline

Investing in the stock market requires more than just market knowledge and analytical skills. Your emotional discipline can determine whether you make or lose a million dollars. It’s about keeping your cool when the market is volatile and sticking to your plan even when it’s tempting to act on impulse.

Avoid Impulse Decisions

Impulse decisions often lead to regret. Imagine you see a stock price plummet and panic, selling your shares at a loss. A week later, the stock rebounds, and you’ve missed out on potential gains.

Instead of reacting impulsively, take a deep breath. Analyze why the stock is falling. Is it a temporary dip or a sign of a long-term issue? Having a checklist can help you make more rational decisions.

Sticking to your investment strategy is crucial. If you initially bought a stock for its long-term potential, don’t let short-term fluctuations scare you away. Have you ever made an impulse decision and regretted it later? Reflect on those moments to strengthen your emotional discipline.

Stay Focused On Goals

Your investment goals should be your guiding star. If your goal is to make a million dollars over ten years, short-term market noise shouldn’t distract you. Constantly checking stock prices can lead to anxiety and poor decisions.

Create a clear plan with specific milestones. Whether it’s quarterly reviews or annual goals, having checkpoints can keep you on track. Are you prioritizing your long-term goals over short-term gains?

Remember why you started investing in the first place. Whether it’s financial independence, retirement, or funding a dream project, keeping your end goal in mind helps you stay disciplined. Write down your goals and revisit them whenever you feel tempted to deviate from your plan.

Emotional discipline isn’t just about avoiding mistakes; it’s about consistently making the right choices. By mastering your emotions, you can navigate the stock market more confidently and reach your financial goals.

Frequently Asked Questions

Can I Make a Million Dollars in the Stock Market?

Yes, you can make a million dollars in the stock market. Success depends on smart investments, market knowledge, and timing.

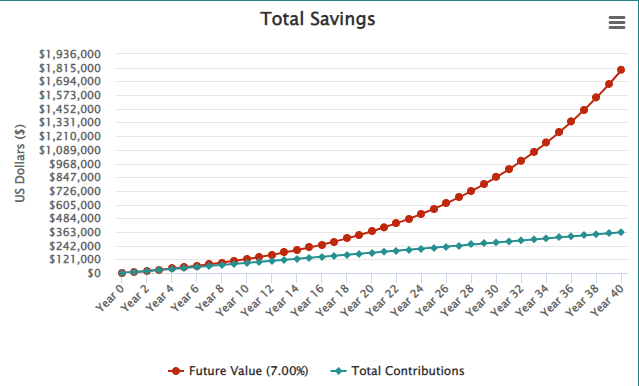

How Long Does It Take to Make $1 Million Dollars in the Stock Market?

The time to make $1 million in the stock market varies. It depends on investment amount, market conditions, and strategy. Some may achieve it in a few years, while others might take decades. Consistent investing and smart choices are key.

How Much Do I Need to Invest to Make $1000000?

The amount needed to invest to make $1,000,000 depends on the investment’s return rate. For example, at an 8% annual return, you need around $215,000 invested over 20 years. Use an investment calculator for precise figures based on your specific return rate and time frame.

How to Turn $100k into $1 Million Fast?

Invest in high-growth stocks or real estate. Start a profitable business. Diversify your investments. Use leverage wisely. Seek expert financial advice.

Conclusion

Achieving a million dollars through stock market investing is possible. Start with small, consistent investments. Learn and adapt as you go. Patience and research are key. Stick to your plan, and don’t let emotions drive decisions. Over time, these steps can lead to significant gains.

Stay focused, stay informed, and watch your investments grow. Investing wisely can help you reach your financial goals.